The Canadian government yesterday tabled its Budget Implementation Act. Running at over 600 pages, the bill includes several notable provisions related to digital policy including the repeal of the Digital Services Tax, the restoration of a privacy provision in the Broadcasting Act that was mistakenly deleted (yet no one noticed for two years), adding a new data mobility framework to Canada’s privacy laws, and creating a new Stablecoin Act. The Canadian Stablecoin Act is modelled on the U.S. GENUIS Act, though there are some notable differences.

The Canadian bill establishes a federal regime under the Bank of Canada to supervise issuers of stablecoins available to persons in Canada. The bill defines stablecoins as digital assets referencing a single fiat currency and requires issuers to be listed by the Bank. While it does not outright prohibit unlicensed issuing (unlike the U.S.), it effectively restricts issuance of stablecoins by requiring registration. The Canadian bill allows any person to the Bank of Canada to become an approved stablecoin issuer with a detailed application that covers governance issues, technical specifics, meeting anti-money laundering rules, and financial disclosures.

The stablecoin issuer must maintain reserve assets that back the stablecoin in the same currency or other high quality liquid assets in the currency and it must include redemption rights (the right to redeem the stablecoin for the underlying reserve asset). Regulations may provide further details on these obligations. There are also monthly reporting requirements to the Bank of Canada and requirements for policies on governance, risk management, data security, and recovery and resolution should the stablecoin cease to operate. The Bank of Canada is provided with a range of powers to enforce the law as well as administrative monetary penalties (about half of the bill related to enforcement and future regulations).

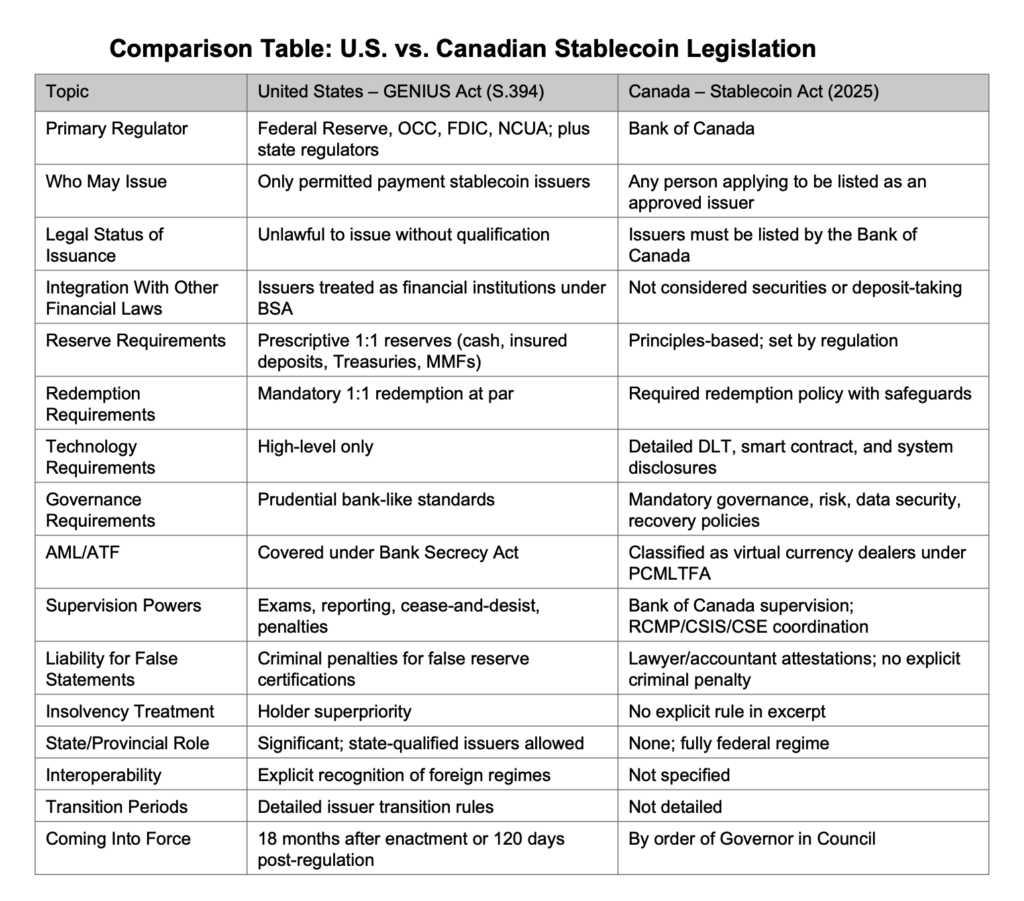

For a comparison of the Canadian and U.S. approaches, I uploaded both bills to ChatGPT, which generated the comparison chart posted below. More on stablecoins and their regulation in this recent Law Bytes podcast with Mohamed Zohiri.

Stablecoin Legislation Comparison (ChatGPT generated)

Thanks for the breakdown of this massive bill! It’s wild that a privacy provision in the Broadcasting Act was mistakenly deleted for two years without anyone noticing. I’m also really interested in the new Stablecoin Act, especially how it compares to the U.S. GENIUS Act. Fascinating stuff!

Pingback: TickerTape 155: Week of 16 Nov 2025 - Chavanette Advisors

Issuers will need to ensure full compliance (reserves, redemption rights, risk frameworks) — which could raise barriers to entry for smaller players. At the same time, regulated issuance may boost legitimacy and adoption.

Okay, so Canada’s diving headfirst into the stablecoin world. Good to see them catching up, but hoping this isn’t just a fancy paperweight – the Bank of Canada’s involvement is key!

Two years of a missing privacy provision? Seriously? Hope this fix isn’t just a tick-box exercise. Data privacy is a big deal, folks!

Stablecoin Act modeled on the US? That’s a bold move! Let’s hope they’ve learned from the US experience – fewer regulatory pitfalls, please!

Many creators don’t realize how much tiktok money they can actually make. Tools like earning estimators really help track growth, analyze video performance, and understand how trends affect revenue.

Canada’s Stablecoin Act brings needed clarity, stronger consumer protection, and clear oversight. Flexible registration, strict reserves, and alignment with U.S. standards make it a smart step toward safer digital assets.

I didn’t know much about stablecoin regulation before this. Now I understand the basics – thanks for breaking it down! The Canada vs US comparison is especially useful.

En Futbol Libre Puedes ver Partidos de Futbol y Canales de Futbol online en vivo y directo. Ver partidos de Fútbol Libre Copa Libertadores, Copa Sudamericana, Boca Juniors y River Plate, Fox Sports, TNT Sports, ESPN, DIRECTV y TyC Canales Gratis.