There was another shooting at a Jewish school in Montreal yesterday, which led to what has become the Canadian version of “thoughts and prayers”, namely a politician lamenting that “this isn’t who we are.” But months of escalating antisemitism make it clear that this is exactly who we are. Just this week, there were shootings at two Jewish schools in Canada, testimony at an Ottawa school board hearing on appalling antisemitism, a mother pulled her child out of a Burlington school due to antisemitism, a lawsuit was filed against OCAD, an Ontario university, for failing to provide Jewish students with a safe environment, and four university presidents told a Commons committee that antisemitism is a problem on campus and that the messaging coming out of the encampments are antisemitic. And it’s only Thursday.

Latest Posts

Curb Your Enthusiasm: Why Bill S-210 Could Mandate CRTC-Backed Age Verification For Streaming Services Like Netflix, Crave and CBC Gem

There are many reasons to be concerned about Bill S-210, the mandated age verification bill that raises significant privacy and freedom of expression risks and which is being improbably backed by Conservative MPs. The bill would mandate age verification technologies that the Privacy Commissioner of Canada says creates concern given missing safeguards, it establishes website blocking that government officials warn could undermine net neutrality and an open Internet, and its broad scope goes beyond pornography websites to include search and social media. But beyond those concerns, government officials have now zeroed in another problem: the definition of “sexually explicit material” used in the bill effectively captures streaming services such as Netflix, Crave, Prime, and CBC Gem. As a result, watching a show such as Game of Thrones or some episodes of Curb Your Enthusiasm on a cable or satellite package comes only with a rating and warning, whereas streaming it via Crave would involve a mandated age verification process.

The Behind-the-Scenes Bill C-18 Battle: How Newspapers, Big Broadcasters and the CBC Are Trying to Seize Control Over How Google Money is Allocated to Canadian Media

Bill C-18, the Online News Act, is best known for two things: the government’s bad bet that Meta was bluffing when it said it would block news links in response to a system that mandated payments for links (news links have now been blocked for 10 months in Canada) and its attempt to salvage the legislation by striking a deal with Google worth $100 million annually. The Google deal has receded into the background, but the behind the scenes there is an intense battle over who will be selected to administer and allocate the annual $100 million. The outcome – which will be decided by Google by June 17th – will have enormous implications for Canadian media for years to come since it is anticipated that Google and the selected collective will negotiate a five year deal worth $500 million. Sources say that two proposals have emerged: a big media consortium led by News Media Canada (NMC), the Canadian Association of Broadcasters (CAB), and the CBC, pitted against a proposal spearheaded by a group of independent and digital publishers and broadcasters that is promising a more transparent and equitable governance approach.

Why Months of Jewish Discrimination and the Normalization of Antisemitism on University Campuses Must Stop

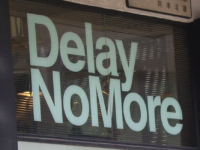

This weekend, two people approached a Jewish girls elementary school in Toronto and fired multiple gun shots. There was no one present at the school at the time, but the shooting will only heighten the fears of a Canadian Jewish community that has now experienced multiple shootings at schools and community centres, attacks on students, and vandalism at Jewish businesses and homes. Politicians moved quickly to issue statements condemning the incident, yet some are the same people that voted against measures to safeguard these institutions or have shown little regard for months about Canadian Jewish community concerns. Further, many supporters of recent protests, including the encampments at universities, have remained silent, presumably saving their voices for criticism of efforts to enforce campus policies to ensure that all students and faculty are safe. I recognize that many protest supporters will reject the suggestion that there is a link between recent campus protests and antisemitic violence, but to my mind, the linkage is clear. Indeed, by normalizing antisemitic speech and downplaying the safety and discrimination concerns of their Jewish colleagues and students, they have provided the fuel for the serious threats that have followed.

Filibuster of Bill S-210 Confirmed: Conservative MPs Put Privacy and Free Speech Online At Risk Over Release of Report

Last week I posted on concerns that Conservative MPs were engaged in a prolonged filibuster at the committee study of Bill S-210, a bill the government has called “fundamentally flawed” since it contemplates measures that raise privacy concerns through mandated age verification technologies, website blocking, and extends far beyond pornography sites to include search and social media. The Standing Committee on Public Safety and National Security is charged with reviewing the bill, but thus far repeated attempts to hear from witnesses have been stymied by a filibuster from Conservative MPs resulting in no witness testimony. With requirements to report the bill back the House shortly, the end result could mean no expert testimony and the possibility of an unamended bill that places privacy and freedom of expression online at risk.