The Canadian government tabled Bill C-100 yesterday, the bill to implement the Canada-US-Mexico Trade Agreement. I will have future post on the key provisions, which include new criminal provisions on trade secrets and tampering with rights management information. The bill also features several provisions related to copyright term but notably does not touch the current general copyright term of life of the author plus an additional 50 years. There are several new terms included in the bill with extensions for anonymous works, performances in sound recordings, sound recordings, and cinematographic works. The bill expressly states that none of the extensions are retroactive which means that the works that are currently in the public domain will remain there even after the new terms are established.

Articles by: Michael Geist

Articles by: Michael Geist

No Mandated Netflix Cancon Payments: Shaw Argues Success Lies in More Regulatory Flexibility in BTLR Submission

Yesterday’s post on the still-secret broadcast and telecommunications review submissions obtained under Access to Information focused on Bell, which proposed extensive new regulations for Netflix that would result in hundreds of millions in payments that could spark a trade battle with the United States. The major Canadian communications companies are not united on this issue, however. While there are similarities on wireless (most oppose mandated MVNOs), the broadcast perspectives differ significantly. This post reveals some of the details in Shaw’s submission to the BTLR, also obtained under ATIP.

Self-Serving in the Extreme: Bell’s Broadcast and Telecom Submission to the BTLR Revealed

The government’s expert panel on broadcast and telecommunications law reform is expected to release its preliminary report on the results of its public consultation next month. The panel has remarkably kept the submissions to the consultation secret, rejecting an open and transparent policy making process that the government insists is essential to good policy development. I filed an Access to Information Act request for some of the more notable submissions (some have been made available and are posted online by the FRPC). An interim release of that request just arrived in my inbox and I’ll have a couple of posts on point over the next few days.

The LawBytes Podcast, Episode 13: Digital Charter or Chart: A Conversation With Teresa Scassa on the Canada Digital Charter

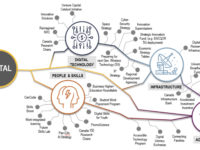

Years of public consultation on Canadian digital policy hit an important milestone last week as Innovation, Science and Economic Development Minister Navdeep Bains released the government’s Digital Charter. Canada’s Digital Charter touches on a wide range of issues, covering everything from universal Internet access to privacy law reform. To help sort through the digital charter and its implications, I’m joined on the podcast this week by Professor Teresa Scassa, a law professor at the University of Ottawa, where she holds the Canada Research Chair in Information Law and Policy.

The Foundation of Canada’s Digital Charter: Privacy Law Reform Focused on a Data-Driven Economy

Prime Minister Justin Trudeau announced plans last week for a new Canadian digital charter featuring penalties for social media companies that fail to combat online extremism. While the just-released proposed charter does indeed envision increased regulation of the tech sector, my Globe and Mail op-ed argues its foundation is not content-regulation but rather stronger rules on how companies use data. Leading the way is a promised overhaul of Canadian privacy law to ensure it is better suited to the challenges posed by a data-driven economy.

The proposed privacy law reforms seek to strike the balance between supporting an innovation-led economic agenda heavily reliant on access to data with mounting public concern over the use of that data without appropriate safeguards or consent. If enacted – the digital charter includes a detailed background paper on privacy law reforms that suggests legislative action will only come after the fall election – the changes would constitute the most significant privacy law amendments in decades.