The Standing Committee on Canadian Heritage conducted the one day of debate on Bill C-11 yesterday that Canadian Heritage Minister Pablo Rodriguez and the Liberal government – aided and abetted by the NDP – required under a House of Commons motion. The result was an embarrassment to the government that leaves a stain that will not be easy to remove. Despite the absence of any actual deadline, the government insisted that just three two hour sessions be allocated to full clause-by-clause review of the bill featuring debate and discussion (MPs on the committee were all open to extending each session by 30 minutes for a total of 7 1/2 hours). With roughly 170 amendments proposed by five parties, there was only time for a fraction of the amendments to be reviewed. Instead, once the government-imposed deadline arrived at 9:00 pm, the committee moved to voting on the remaining proposed amendments without any debate, discussion, questions for department officials, or public disclosure of what was being voted on. The voting ran past midnight with the public left with little idea of what is in or out of the bill. The updated bill will be posted in the next day or so.

Blog

Why is the Canadian Government So Indifferent to Privacy?

Over the past several weeks, there have been several important privacy developments in Canada including troubling privacy practices at well-known organizations such as the CBC and Tim Hortons, a call from business organizations for privacy reform, the nomination of a new privacy commissioner with little privacy experience, and a decision by a Senate committee to effectively overrule the government on border privacy rules. These developments raise the puzzling question of why the federal government – led by Innovation, Science and Industry Minister François-Philippe Champagne, Public Safety Minister Marco Mendicino, and Canadian Heritage Minister Pablo Rodriguez – are so indifferent to privacy, at best treating it as a low priority issue and at worst proposing dangerous measures or seemingly hoping to cash in on weak privacy laws in order to fund other policy priorities.

Defending the Indefensible: If Bill C-11 Won’t Pass Until the Fall, Why is the Government Cutting Off Debate and Review Now?

The government’s motion to cut off Bill C-11 debate will head to a vote on Monday as it seeks to wrap up submission of amendments, voting on all amendments, the House of Commons report stage, and third reading within a week. Liberal MPs argue that Conservative filibustering at committee necessitates the motion, yet with Canadian Heritage Minister Pablo Rodriguez acknowledging that a Senate review of the bill will likely have to wait until the fall, there is no deadline and no obvious need to curtail proper review of amendments and House debate. Indeed, by rushing through the amendment review of the bill, the government undermines the credibility of the committee process and makes a full Senate review even more essential.

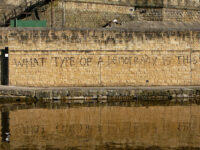

Secret Law Making, the Sequel: As Youtubers Speak Out Against Bill C-11, Government Moves to End Debate, Vote Next Week on Secret Amendments

With only eight days left in the Parliamentary schedule until the House of Commons breaks for the summer, Bill C-11, the Online Streaming Act, has entered into a strange parallel universe. In one world, the government is moving to end debate on the bill and expedite passage in the House by the end of next week. Assuming it is successful – NDP support suggests it has the votes – the government has set a deadline of Monday, June 13th for amendments, June 14th for voting on all amendments as part of a clause-by-clause review, and then a single day for the last two stages in the House of Commons (report stage and third reading). Put it all together and it wants the bill passed by the House by the end of next week.

The limit on the clause-by-clause review to a single day means that the Heritage committee will likely reprise its approach from Bill C-10 of voting on amendments that the public has never seen, that are not read in committee, and are not subject to any discussion or debate. These secret amendments – they will only be revealed to the public after the entire process is complete and the new, updated bill is made public at the report stage – is particularly egregious.

The Bill C-11 Effect: “Any Video on TikTok That Uses Music Could be Subject to Regulation”

TikTok did not appear before the Standing Committee on Canadian Heritage as part of its Bill C-11 study, but one of the world’s most popular user generated content sites issued a warning that even Canadian Heritage Minister Pablo Rodriguez can’t ignore: if the bill becomes law, “any video on TikTok that uses music could be subject to regulation under the Broadcasting Act.” TikTok’s analysis picks up where Rodriguez left off at committee as he sought to downplay the effect of the bill on user content and dangerously equated some of the concerns with misinformation. Yet despite the persistent denials, TikTok’s submission to the committee leaves little doubt that any Canadian who uses the service to create a video with music backing will find their content caught by the bill.