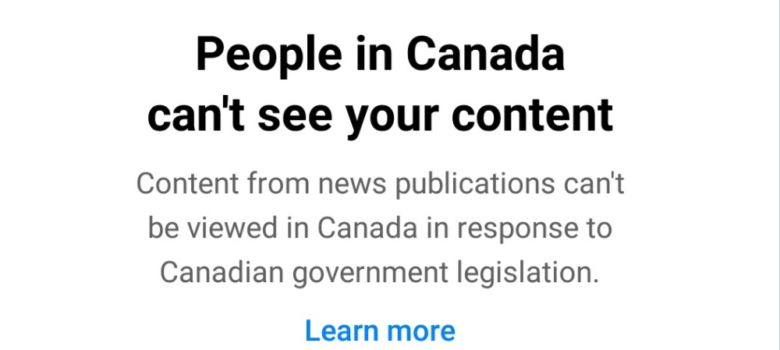

Coming off a week in which the government engineered a major cabinet overhaul that saw Heritage Minister Pablo Rodriguez replaced by Pascale St-Onge, an escalation of the battle over digital services taxes, and which featured significant news on both the Bill C-11 and Bill C-18 fronts, this week’s Law Bytes podcast provides a mid-summer update on recent developments. Barring some urgent news, the podcast will be taking a break in August and return in September.

The podcast can be downloaded here, accessed on YouTube, and is embedded below. Subscribe to the podcast via Apple Podcast, Google Play, Spotify or the RSS feed. Updates on the podcast on Twitter at @Lawbytespod.

A couple of items.

1) The download link points at episode 175, not 176.

2) With respect to the DST, typically corporate, and business, income tax is on profit, not revenue. Is the proposal really to tax revenue? The problem with the idea of “fair share” is that the concept of “fair” is subjective.

“… income tax is on profit, not revenue.”

Must be nice. *Personal* income tax is on what you make, whether you spend your income on mortgage/rent, food, or whatever you need for you and your family to survive.

People don’t have the same opportunities to do a “Double Dutch” or a “double Irish with a Dutch sandwich” or a “shell company” as the lucky corporations to make sure they look profitless when the taxman comes around.

Those advantages are not for us proles under the rule of JustInept. Loblaws gets millions for new refrigerators and we taxpayers get the bill.

Don’t forget that the companies pay for the items that they sell, for instance Loblaws doesn’t get the Cherios that they sell for free. In addition the workers at Loblaws don’t work for free. That, as I understand it, is the rationale for why income tax for corporations is on profit, not revenue. General Mills in Canada is liable for income tax on their profits; the employees pay income tax. To tax the revenue would result in even more double taxation than we have now (for instance, sales tax is a form of income tax on the revenue from goods and services sold).

The profit margins in some industries is higher than in others; for instance the margins at grocery stores is higher than many companies, however they cannot get a refund from their suppliers for items that spoil. What it cost them to buy it comes out of the profit they make on what they actually sell.

As far at shell companies, in theory they are liable for corporate income tax on their profits in their home jurisdiction. This is often outside of Canada in a place with lower corporate tax rates, but it could be in Canada or the US.

However some of the revenue is distributed to shareholders in the form of dividends; these shareholders can be other corporations or people like you and me directly or indirectly (by way of pension plans and retirement savings through mutual funds, etc).

For the record, I have no affiliation with Loblaws, however I do have some experience in grocery retail; my parents owned a small independent grocery store 40 years ago which I worked at while going through high school.

In fact, in Canada you don’t pay income tax on all of your income, only on the “taxable income” portion. There is the basic personal exemption, exemptions for dependents, EI, CPP, union and professional dues, pension plan contributions, and in Manitoba rent (but not mortgage) payments, alimony (and if I remember correctly child support) paid, are all used to reduce the income to calculate the taxable income. And then there is charitable and political donations (the latter being more lucrative). If you are self-employed or a student there are other deductions that come into play.

And then there are the “boutique” tax credits available that governments use to buy votes. In many cases these are “income tested” meaning that people who have higher incomes are not eligible to claim them.

Thank you for producing such a fascinating essay on this subject. This has sparked a lot of thought in me, and I’m looking forward to reading more.

HY

Pingback: Leftover Links 01/08/2023: Twitter de-X’ed, Microsoft Blasted for Epic Breach | Techrights

Your expertise is quite enlightening. You can think critically and provide a full solution, which proves your intelligence.