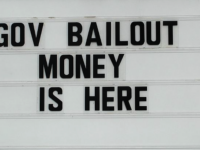

The government has taken the first step to creating a bailout for its disastrous Bill C-18 by agreeing to News Media Canada demands to increase the support under the Labour Journalism Tax Credit. While the current system covers 25% of the journalist costs up to $55,000 per employee (or $13,750), the government’s fall economic statement increases both the percentage covered and cap per employee. Under the new system, which is retroactive to the start of this year, Qualified Canadian Journalism Organizations (which covers print and digital but not broadcasters) can now claim 35% of the costs of journalist expenditures up to $85,000 per employee. The increases the support to up to $29,750 per employee or an increase of 116%. This new support will run for four years at a cost of $129 million ($60 million this year alone).

Post Tagged with: "fall economic statement"

Law Bytes

Episode 258: Jaxson Khan With an Insider Perspective on AI Policy Development in Canada

byMichael Geist

February 23, 2026

Michael Geist

February 9, 2026

Michael Geist

Episode 256: Jennifer Quaid on Taking On Big Tech With the Competition Act's Private Right of Access

February 2, 2026

Michael Geist

The Law Bytes Podcast, Episode 255: Grappling with Grok – Heidi Tworek on the Limits of Canadian Law

January 26, 2026

Michael Geist

December 22, 2025

Michael Geist

Search Results placeholder

Recent Posts

The Law Bytes Podcast, Episode 258: Jaxson Khan With an Insider Perspective on AI Policy Development in Canada

The Law Bytes Podcast, Episode 258: Jaxson Khan With an Insider Perspective on AI Policy Development in Canada  Time for the Government to Fix Its Political Party Privacy Blunder: Kill Bill C-4’s Disastrous Privacy Rules

Time for the Government to Fix Its Political Party Privacy Blunder: Kill Bill C-4’s Disastrous Privacy Rules  The Law Bytes Podcast, Episode 257: Lisa Given on What Canada Can Learn From Australia’s Youth Social Media Ban

The Law Bytes Podcast, Episode 257: Lisa Given on What Canada Can Learn From Australia’s Youth Social Media Ban  Court Ordered Social Media Site Blocking Coming to Canada?: Trojan Horse Online Harms Bill Clears Senate Committee Review

Court Ordered Social Media Site Blocking Coming to Canada?: Trojan Horse Online Harms Bill Clears Senate Committee Review  An Illusion of Consensus: What the Government Isn’t Saying About the Results of its AI Consultation

An Illusion of Consensus: What the Government Isn’t Saying About the Results of its AI Consultation