Canada has a well-earned reputation for some of the highest wireless prices in the world with numerous comparative studies finding that consumers pay relatively high prices for low amounts of data. There are obviously many factors behind pricing, but for many consumers the top line issue is how much does the wireless service cost and how much data do I get? Rewheel Research, a Finland based consultancy, has been at the forefront of pricing comparisons with extensive analysis of mobile data pricing in countries around the world. Its reports have often called out Canada, recently noting that prices are “a world apart” from more competitive markets. With Canadian telco giant Telus commissioning a study to challenge the Rewheel research, I’m joined this week on the Lawbytes podcast by Antonios Drossos, managing partner of the firm, who talked to me from Helsinki about their findings, what lies behind Canada’s wireless pricing, and the Telus-backed study.

The podcast can be downloaded here and is embedded below. The transcript is posted at the bottom of this post or can be accessed here. Subscribe to the podcast via Apple Podcast, Google Play, Spotify or the RSS feed. Updates on the podcast on Twitter at @Lawbytespod.

Episode Notes:

Rewheel Research: The state of 4G pricing – 1H2019 – Digital Fuel Monitor 11th release

Credits:

House of Commons, June 10, 2019

Transcript:

Law Bytes Podcast – Episode 21 transcript powered by Sonix—the best audio to text transcription service

Law Bytes Podcast – Episode 21 was automatically transcribed by Sonix with the latest audio-to-text algorithms. This transcript may contain errors. Sonix is the best way to convert your audio to text in 2019.

Michael Geist:

This is Law Bytes, a podcast with Michael Geist.

Charlie Angus:

On a two gigabyte plan where you pay about 75 bucks a month Canadian for a two gigabyte plan on your phone and you can still get gouged on top of that. In Paris, you pay 30 bucks. Rome, 24. Now, they might say that’s not really fair. You know, it’s different in Europe. So let’s compare a similar sized country with a similar sized population, similar size large rural regions, Australia. Australians pay $24.70 a month on average for two gigabytes. And in Canada, we’re paying 70.

Michael Geist:

The competitiveness of wireless markets has emerged as a major political issue in countries around the world as consumer pricing for those services attracts mounting attention. Many consumers and by extension media coverage looks to comparative data to see whether their pricing is “high or low”. There are obviously many factors behind wireless prices, but for many consumers, the top line issue is how much does the service cost and how much data do I get? Rewheel research, a Finland based consultancy has been at the forefront of pricing comparisons with extensive analysis of comparative mobile data pricing in countries around the world. Its reports of often called out Canada recently, noting that our prices are a world apart from more competitive markets. With Canadian telco giant Telus recently commissioning a study to challenge the rewheel research, I’m joined this week on the podcast by Antonios Drossos, managing partner of the firm. He talked to me from Finland about their findings, what lies behind Canada’s wireless pricing situation and the new Telus backed challenge.

Michael Geist:

Antonios, thanks so much for joining me on the podcast.

Antonios Drossos:

Thanks, Michael, and thanks for inviting us and giving us the opportunity to actually discuss about the work that we’re doing.

Michael Geist:

Okay, that’s great. What do we actually start there? Can you tell me a bit about your company and the reports you produce and who relies on your services and reports?

Antonios Drossos:

Yeah. So actually, you know, what is not widely known is that we are basically consultants. The independent research that we do is a side thing. So basically, when we are not very busy consulting operators, regulators, competition authorities and all the rest of our clients, then we do this independent research. The company was actually founded, let me remember now to was 2009. So we Rewheel has been operating now for over 10 years. Our background is basically 20 years from the industry. We started from equipment vendors. Then we work for mobile operators, wireless operators, and then went into consulting. We myself and the other founding partner Pal Zarandy, has been basically working for consulting after we left the operators mobile operators for some years. And at some point we were involved with mobile data. Back in 2007, 2008, and we we show a great opportunity to actually create the really specialized focus consultancy on mobile data. We were expecting already that mobile data and mobile broadband would become really, I would say, central, you know, going forward as it finally became, you know, in many countries. And that’s how we set it up Rewheel. So most of our work we do from consulting most of the income, we actually comes from consulting. And, you know, in our spare time, we do this independent research and we are kind of like a different of consulting firm because we take public, we take our opinions public. So we are pro competitive. We mostly work with clients that have similar views with us. And we usually very upfront on this when we meet a new client, either this is a private operator or is it a regulator or a competition authority would tell them this is our views can answer any you kind of like like what you hear or would be happy to to work with you.

I say a few things about our research we got involved in to the state of the European mobile markets back in 2012. We have done a lot of work privately and then we saw that some markets, you know, effective competition was working in some markets was not working pretty well. And ourselves, we had the can we ask to see, you know, why is this happening or what is actually drives competition in wireless mobile markets. So we started our research back in 2012, our independent research. And when I say independent, nobody pays on our research is an activity that will carry, you know, with our own initiative and we find ourselves in our show from their proceeds of the revenues of the companies. And back in 2012, the European Commission, the antitrust authority in Europe, took notice out of one of our first studies about the what drives competition in the European wireless markets and decided our study, they they they they start discussing with us. And since then, we basically have been doing a lot of research in the state of competition, primarily pricing prices in European and overseas markets. And as well, we have done a lot a lot of work in mergers 4 to 3 mergers. You know, that’s a short introductions. What do we do.

Michael Geist:

That’s perfect. And in fact, it’s certainly it’s the pricing competition reports that lead Canada attracted some attention in terms of just we’ll get into some of the most recent reports, including one from April of this year that examined 4G pricing. Where does the data come from that underlies the reports?

Antonios Drossos:

Yes. So we basically started with this methodology back in 2014. I mean, our idea and you know, this is not often a lot of people that read our reports make them mistake to talk about the price of mobile communication services. This is not what we measure. I mean, when we design the methodology back in 2014, we were focusing to actually, you know, measure and track the price of mobile or wireless broadband connectivity. That’s what we are aiming with our research. So basically, you know, back many years back, you know, customers, consumers were buying voice services, SMS services and increasingly mobile data services starting from 2007 onwards. But we saw that a few years down the line that actually mobile broadband connectivity and mobile data will become the central. That’s a commodity that wireless operators are selling. So when we design it. Designed to measure that, so we measure it in two specific plans. This is the model plans that it may have as well or half as well. Voice and SMS and we measure it as well as data only. That is the mobile broadband in our terminology. And how we do it is we basically it is entirely based on public data. So twice a year, as you probably know, this will have this the monitor releases since 2014. We go and we collect ourselves in, you know, in the web from the websites of all the operators, MVNO, not subbranch of the operators. We’re looking for specific plans. We are looking for consumer plans. We’re looking for consumer monthly rolling plans. Some people always make the mistake that we track only postpaid or prepaid, no. We track monthly rolling plans and only the payment is postpaid or prepaid. We don’t really care what we do not track. We do not track prepaid plans that they are not month, meaning that you are buying an allowance for, I don’t know, three months and then it expires. And when you collect all the data, you know, then we carry on down listeners with two specific metrics that we have been using. Most of those years. And then button click, you know, the public personal report with the main findings. And then there is obviously that the full version which contain more detail analysis.

Michael Geist:

Right. So in many ways that that kind of scan of pricing reflects what a consumer would see if they were going out into the market and looking out for those kinds of services.

Antonios Drossos:

Exactly. And that was that was our intention. I mean, obviously, that before us and still there is a number of actually private companies that measure the price with mobile communication services, different services. And and those are primarily targeted for their operators. Can a poor computer better intelligence to see how their competitors are pricing our again? You know, our sole focus is the competitiveness of mobile broadband connectivity. I mean, we are trying to expose the naked price of, you know, wireless connectivity, mobile data or broadband connectivity, how you want to call it.

Michael Geist:

Sure. Interesting. So that I obviously want to get into what you find from a Canadian perspective, given that it’s attracted a lot of attention here. But before we do that. Can you give us a sense of where are we worldwide on pricing? How have things evolved over the years that you’ve been tracking this? And where do countries stand now? What are the kinds of countries that stand out when it comes to their 4G pricing and competitiveness?

Antonios Drossos:

Yes, I think this is really, really fascinating stuff because, you know, we realize ourselves and we actually start driving prices back. We started as early as 2012. But for OECD countries we included, obviously the countries within our European, the European 28 countries starting on 2014. So the most fascinating thing is the price development. I mean, obviously, you know, the price measure back in 2014 compared to the price of 2019. And now we can all have all these very rich data. And it’s worth mentioning that every single DF monitor release contains thousands of actually plans, thousands, thousands of tariff plans from, you know, all of them mobile network. But those in the country, there are sub brands, meaning discount brands also call and as well the major MVNOs in the country. Now what we actually see that the prices of gigabyte, which is basically the main metric that operators are using to tier their plans and, you know, explain, you know, the amount of data that their plans contain has been dropping really off of a cliff within the last four or five years and has continued to drop till the late last release, which was April 2019. The same is true for Canada. The same is true for all the 41 countries that we have been tracking the last four or five years. You know, gigabyte prices have been falling. Now, there is still important caveats and two important findings in all of that. Our data suggest that prices gigabyte prices fall faster in markets where there is four mobile medical operators, the 4 MNO markets, as we call them, than in 3 MNO markets. And that’s has some, let’s say, repercussions, I guess, you know, as we as we interpret them, the higher that the competition appears to be more effective appears to be more intense in markets where there is more mobile network operators versus less mobile network operators. And that’s also as a result that Ofcom, the regulator in the UK, found from their own study back in 2015, if I remember.

Antonios Drossos:

Now the other the other important trend and this is something that we highlight in almost every single release that prices in four MNO markets are tend to be much, much lower gigabyte prices than in 3 MNO markets and again, you know, there is a very important conclusions, words which we make and, you know, a lot of regulators and competition authorities seem to acknowledge by citing our research, including the Competition Bureau in Canada, which recently gained access to our research and gained access to. It’s important to mention that the competition authority in Canada have recently got access to raw tariff data because what they wanted to do is that was to use our raw tariff data for the last five years to make their own analysis, not apply our own metrics. But, you know, do their own analysis and come to their own conclusions. You know what do you suggest for them for the future of the Canadian wireless market.

Michael Geist:

Okay, interesting. So the Canadian authorities are looking at your research, not purely from the reports that you’ve been developed, but rather the raw data that you’ve been collecting specifically.

Antonios Drossos:

Exactly. Specifically, they they want to go to their own analysis on the raw tariff data that we have collected the last five years.

Michael Geist:

Right. So I just have to make sure that it’s clear. So we’re looking at those last five years. What you’re finding is that those countries are looking at 41 countries worldwide and emphasis on Europe, looking at countries around the world, those with more competitors with four network operators tend to have lower prices and tend to have prices that drop faster than those that have fewer competitors, say three.

Antonios Drossos:

Exactly.

Michael Geist:

Okay. Which, of course, brings us then to the Canadian market, because that’s become a big focal point, certain certainly of our government. What does the report find from a from a perspective in terms of where Canada stands relative to other countries around the world?

Antonios Drossos:

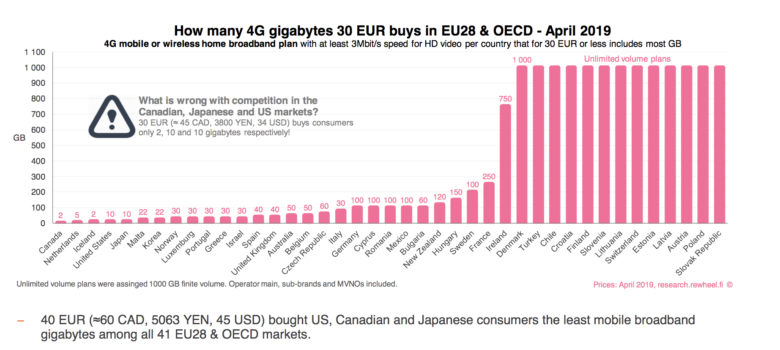

Yeah. I mean, basically, we find what everybody else found when they actually tried to compare and benchmark the prices in the Canadian wireless market. Prices the absolute the level of prices, meaning the monthly price for a plan either been there’s been a smartphone plan that includes minutes, SMS being a mobile broadband plan are substantially higher than other countries in OECD and as well as European markets. And as well, the gigabyte prices is much, much higher than many other countries. And that’s again, you know, I’m kind of like emphasizing on that because some obviously for obvious reasons, you know, the incumbents in Canada may not like this finding. But this is a finding that, you know, I could easily name three or four different, you know, independent research that has come to this to the same conclusion. And now the the real question, and I don’t think that there is a debate that Canadian prices are higher than prices in wireless pricing or gigabyte prices in other OECD or European markets. The real question is why?

Antonios Drossos:

Now through these five years that we have doing this independent research ourselves, we we kind of like we have seen every single market and and the main character, this is every single market. And we came to the conclusion that while there is a number of factors that affects prices, both that, you know, the monthly level and as well the so-called variable level or the gigabyte level nowadays in wireless. The most important factor of that is the number of competitors, which obviously it is not a let’s say it is not something new in terms of economic policy. You know, the whole competition law is build up on the idea that, you know, very few competitors, you know, lead to oligopolies lead to duopolies lead to monopolies and that obviously lead to higher prices and consumer harm. And and we believe the fact that the Canadian market has, in essence, three national operators. Yes, we do ourselves qualify Canada as a market with four operators because we kind of like consider Freedom owned by Shaw nowadays to be the fourth national operator. And I think they are en route becoming one. You know, they’re expanding their coverage continuously. But but clearly, this is this is not, you know, a black and white, you know. So we think that if a fourth operator or like Freedom, which unfortunately, you know, unfortunately neither of you was actually acquired by Shaw, was to emerge as a strong fourth, mobile competitor, we believe this will only improve the situation in Canada. And I know I know that there is a lot of discussion ongoing right now because of the current CRTC review on. And there’s a lot of focus on MVNO, the so-called mobile better network operators or the guys who actually buy wholesale access from the actual network operators and then they retail to add to to their consumers. However, you know, our research would have done a lot of work in their area, suggest that while they could help and primarily that could, let’s say, help to lower prices in the short term. The problem with mobile virtual network operators is that inherently wholesale access on mobile network do not work. And you know, if you like to ask more, I can go on and more in details. But and I can I can use some cases from the European market to illustrate why it doesn’t work that well. And effectively you will need a network operator in the long run if you want to have effective competition.

Michael Geist:

Ok. I mean, it is worth it’s not where I thought we’d go, but I think it’s it’s worth focusing focusing on at least for a moment. Do you collect MVNO data as well? Regardless of what what do you see as the experience with MVNO? I suppose in Europe?

Antonios Drossos:

Yes, we do. We do. We do collect. I mean, since the start of DF monitor, as I as I mentioned earlier, you know, we collect the network, the price of the network operators in every country, the price of their sub brand discount brands. And as well, the price is offered by major MNVO also in the country. And so there is over 70 MVNO, as you know, this 41 countries that we track on on a regular basis. And that was one of the interests as well of the competition authority in Canada. They want to see how does the pricing of this can be and how competitive it is compared to their pricing of them. So, I mean, to make it very clear, because this was a huge debate that we we went through in Europe between 2014 and 2018, because back in 2014, the European Commission, which is their antitrust authority in Europe, approved 3 – 4, 2 – 3 mergers in Europe, not by creating a new fourth network operator, but by by giving wholesale access to MVNOs. And there was a big debate. Can MVNO actually substitute the competitive pricing accepted by it for mobile network operator? So the problem lies on the front end and it is quite easy to fall.

Antonios Drossos:

So let’s say that. And I had I had this discussion already with the Competition Authority in Canada. Let’s say that CRTC, you know, mandates wholesale access obligations to them, to the network operators, and then several MVNOs can can can purchase that wholesale access and can reach their consumers with their own retail offer. Now, the major question will be what should dictate the price, the price for which they were buying mobile data from the network operators? And how do you do that? And the moment that you start going into that discussion, things become very, very complicated. And I will explain why. Because it is let’s simply say that in Canada, you know, 40 dollars, you usually buy max 3 – 4 gigabytes per month in a smartphone plan that has unlimited minutes and SMS. That’s more or less what you buy in Canada. So let’s say that CRTC comes in, dictates the price. And now the MVNO could offer for a bit less the same gigabytes for 30 or 35 dollars. They could offer those four gigabytes rather than for forty dollars. Or they could build a bit more fewer gigabytes, say six gigabytes for forty dollars right now, the four of them MNOs have been selling on retail. Yeah. So essentially this is a retail minus model. But the real question is that when a network operator comes into the market, for example, look at Iliad, that they just became the new fourth operator in Italy, the whole gigabyte price. You know what? The market knew before or what was, let’s say, the norm? How many gigabytes should you buy if you spend 20 euros, you know, when in a completely different level nowadays you buy in Italy for 7, 8 euros per month, unlimited amounts minutes and SMS and 50, 60 gigabytes. Now was unheard before the network operator came to the market. And here is the really question I’m asking. There is no wholesale access offer that they will make an MVNO to offer 10 times or 100 times more gigabytes for the same price that the network operators are offering in the market. Because obviously the network operators will never agree to such a wholesale offer. Meaning that an MVNO in mobile wireless would never be able to replicate the near zero marginal data cost of a network operate or meaning that an operator could offer unlimited. As you know, in 23 countries out of the 41 OECD and 28 European countries operators are often truly unlimited service for 20 – 30 euros a month. Now the question one will ask, but how can they afford it? How can you offer a truly unlimited service similar to fixed broadband and still make money? Well, they could, they can, because of the the marginal cost for mobile operators often come at near zero. And the more, you know, the technology evolves and we move to 5G, that their actual ability, the capacity of mobile networks to offer a lot of traffic means that the incremental cost for operators who carry out incremental traffic is really, really small.

Antonios Drossos:

So to conclude, what we have seen is number one commercial MVNO, they don’t, they cannot offer, you know, so attractive and competitive offers as network operators, they’re the fourth network operators and you know, they will. It’s impossible for a regulator to set a price for wholesale mobile, for wholesale access, for mobile data, because it will find itself on the problem that every three months or every six months it will have to change this price because the network operatiors will be, you know, all the time will be lowering the gigabyte price on their own retail plans, you know? So it is almost impossible.

Michael Geist:

Ok. That’s a that’s some valuable insights. It does sound to me that they’re the difference in many ways between an MVNO approach and a new operator or an MNO approach comes down to whether or not you want a transformative change in the marketplace that injects competition or something that feels far more incremental and creates some challenges along the way. May result in some lower pricing with some new competitors from a consumer perspective. But it’s not going to shake up the marketplace in quite the same way that a fourth network operator would. Now that that debate is going to continue to play out here in Canada over the coming months, as you mentioned, the CRTC studying the issue and the government’s sending strong signals about where we’d like to see things go. But the large providers in Canada, the incumbents have been reacting strongly, certainly to even the suggestion that Canadian prices at the moment are high relative to other countries and taking aim at a number of reports along those lines. Telus in particular has commissioned reports from the NERA Economic Consulting Group, a US firm that tries to call into question some of those reports. It started first with something known as the Wall Report and most recently took aim at your reports. So I guess I’d start with any initial comments on the Telus effort as it looks to NERA Economic Consulting to sort of look through and assess what it sees as some of the shortcomings in which the work you’ve been doing.

Antonios Drossos:

Yeah. Well, as we actually said publicly on Twitter as well, we we responded by saying we’ll be happy to actually respond to any critic if that critic is independent. And you know what? We presently passed to Telus because we actually were in discussion with Telus. You know, a few weeks ago. And there is so there is some background on this on this activity by Telus is that obviously that were not the first operator to do that. I mean, throughout the, you know, 10 years that we have been around because of this independent research and because a lot of operators will feel very strongly about the findings of our research, claiming that their prices are high compared to other markets or not. You know, they have done it before. And as I said to Telus they will do it again. You know, there will not be the last operator that did that. But but interestingly, as I mentioned, you know, we were in discussion with Telus, you know, about our services, about our research. And we are we were asked by Telus if we would be willing to do to do to carry out the study paid by paid by them for which study they would have a say. And, you know, our response to them. And it’s it’s not different to any other customer. You know, it’s always no. I mean, the studies that we do are independent and are always, you know, aim at the independent authorities, at the policymakers, you know, and the competition authorities, the regulators on the call, the competition authorities, you know, meaning to conclude, you know, on that related It’s not that we haven’t seen reports like NERA before which criticize, you know, our our status and methodology. And we have responded, you know, if such a report was actually, you know, independent. But in this particular case, you know, we didn’t really feel that, you know, the report was independent. And again, which probably, you know, it will be interesting. Interesting for you for you to hear is that there was a lot inside that report. And while, you know. So the problem with with this type of study, is, as I said, we were in the start of our call. We have a very specific task with our research, and that is to measure the price of wireless naked wireless connectivity. Now, there is many other prices. There is, you know, a lot of wireless operators. They’ve been selling washing machines and they could actually bundle the washing machine together with with their service for mobile service or mobile broadband service. But we are looking always specifically for for for their broadband connectivity and go to benchmark those prices. But if you have any specific comments, you know that you want to touch on that the NERA report, I would be happy to to give some quick responses.

Michael Geist:

Yeah, sure. I guess there’s there’s two that I thought I might might ask you about. And I think you’ve actually I think in some ways responded to the first. One in the NERA report emphasizes that there are other factors at play beyond just the data allowances that you’re taking a look at. They talk about network quality, customer service and those kinds of things. I’m guessing, I’d love to hear what you have to say, that that in many ways that doesn’t really undermine your conclusions at all. You’re looking at relative pricing and they’re saying, well, yeah, but you should you should be thinking about other things. But that’s that’s a different study. And from the perspective of a consumer, maybe they care about that, maybe they don’t. But those that care about pricing would would I’d imagine look at your study and see that it’s useful.

Antonios Drossos:

Yeah, I mean, absolutely. I mean, this I think I think it’s pretty obvious when we measure prices and when we talk about markets being competitive or non-competitive, the focus is on prices. You know that one will argue that there is other things, for example, like customer care, which is the most competitive market. It does and has the best customer care. Well, obviously, it is not part of, you know, our methodology and you know, to actually rebase the whole discussion, because, you know, that’s that’s the main reason why we tend to avoid, you know, responding and going into details to such critique. You know, usually that is made by operators for the specific reason that, you know, I mean, they do not price customer care. The last time that a Canadian operators, wireless operators price on gigabytes, meaning that price almost like anybody else. So if you price on gigabytes and you are I mean, these have very, you know, linear pricing on gigabytes and you don’t price on other factors. It’s easy it’s hard for me to understand how you could turn this argument around and you say that price doesn’t matter and gigabytes doesn’t matter because other things.

Antonios Drossos:

But I want to comment with other things because it’s it’s important. So we never said that mobile networks in Canada are not of a good quality. We never said that, you know, the Canadian market is not competitive because the the quality of mobile networks really sucks. What is important to note, and NERA had presented the consumer survey about what other factors is important to consumers when they decide what service to buy. You know, mobile communication service or in this case, broadband mobile broadband service to buy. They present it. Consumers have it from the US, if I remember well, which anyway, still had price and gigabyte allowance on the top, although not with the percent that is that we have seen from independent consumer surveys. And I want to pick one specifically because you know, even consumer surveys, you would make it with a very different way and that it matters who makes the consumer survey. The European Commission, when it examines four to three mergers, it all most of the times, well, not always, but most of the times countries is independent consumer survey. They do that because they want to determine the diversion and the switching ratios between the operators. But when they do those consumer surveys, they do ask how people make their decision, which provider and which plan to choose. And in those surveys, that independent surveys that we have seen from the European Commission commissioned by the European Commission, we saw 87 percent the attractiveness of the priceline, meaning the price and the gigabyte. That’s 87 percent, 22 percent that were network reliability and 5 percent network performance. Yes, other things matter. But, you know, the thing that matters the most is the price. And how much can you use the service? And this is pretty straightforward.

Antonios Drossos:

Now, two more things. I think this is an important point. I will take a bit more time to elaborate on this. One, whoever is familiar and I’m pretty sure not a lot of policy makers, not a lot of consumers are familiar with competition law. Competition law has prices central to its design so that the purpose of competition law is focuses in preventing consumer harm through price increases. Yes. And the independent research that we are doing is usually an input to competition law, because that’s exactly what competition law is thinking. Yeah, other stuff when competition authorities are looking at the effect of competition in the market through a merger or other stuff, they look at other stuff as well. But their main concern is that will this merger, will this concentration increase price in the market? And that’s important to remember.

Antonios Drossos:

You know that usually operators there, they use their investment as a counter argument. You know that, you know, mergers and more consolidation helps operators to invest more. But even that, you know, the European Commission has rebut this argument by presenting data from France that went from a 3 to 4 operator market between 2012 to 2018. And so that actually network investment in the market increased.

Antonios Drossos:

And my final point about network quality in Canada follow or this is mentioned in the NERA report, they use an open signal. Open Signal are crowd source application that measures the speed and other quality factors on mobile networks around around the world. And they you know, in in opposing the reports, you could see that Canadian operators in Canada runs high on the average download speed. You know, however, it’s important to note that both open signal and another Canadian company called Total as well, which I will save, and they have more reliable data, crowd source data. And they are very active around the world. And we have work with them producing a white paper. Basically say that the quality of the networks in Canada is really top tier, but similar on par with the quality of the national networks in the Nordics. You know, for example, Finland where where we come from. And here is the interesting thing. I mean, the pricing benchmark reports that you do is not the only report. We do a lot of reports about capacity, network capacity on on potential network capacity, potential out of mobile networks around around the markets that we look.

Antonios Drossos:

And in order to do those reports, we collect a lot of data. For example, one of the data that you collect is the number of sites that different mobile network operators have in different countries. Now, Finland, the three Finnish mobile operators have our own 7000 sites. This is the physical sites there where you could actually you could have an antenna. Now, from the information that we have, this is more or less the same amount of sites that Canadian operators have. And what do we do not understand, which is also used by NERA as it now given, you know, against our methodology and our guest there, there there are conclusions claiming that mobile nobles in Canada are really of high quality. Is that Canada has seven times or six, seven times more people than Finland and 30 times more area. But Finnish operators have as many sites as Canadian operators. So it’s a bit difficult, you know, to actually argue that the quality in Canada would be better than the quality in the Nordics. You know, and Finland has a lot of sites in the Nordics, but other Nordic countries have similar a lot a lot of sites and claim that this is the reason why the prices are actually much higher in Canada. So we don’t really we don’t really buy that argument. And we believe that the main reason that prices in Canada is higher is purely for competition reasons.

Michael Geist:

Ok. And in some ways, I think that’s a good, good way to end it ultimately. Canadian policymakers, the government and I think Canadian consumers are really looking to understand why is it that their own, I think, experience when they go elsewhere, as well as reports such as yours and others, consistently suggest that the pricing and focusing on the pricing, which I think, I personally agree with you, I think that’s what consumers are primarily concerned with is far higher in Canada than it is elsewhere. And I take it that your takeaway, having looked at countries around the world at this now for many, many years, is that it ultimately is all about competition.

Antonios Drossos:

Yes. Yes, it is. And if I have one more minute, I think that what I can say is that because to make it more concrete for other people, you know, what exactly do we mean by competition? I mentioned France briefly. And it’s important. France and Netherlands are two very important markets in Europe because they used to be 3 MNO markets. And nowadays the number of network operators in the market doesn’t increase that often because there is less and less spectrum in offer and the higher barriers of entry. But it’s important to not do not that both in 2012, both of France and the Dutch market went from three to four. So there was a new fourth operator in the market. Now it’s important to note that back in 2011, 2012, France and Netherlands were one of the most expensive European markets. Well, in 2018, they became some of the cheapest of the European markets. After four or five years of having a fourth operator operator into the market. And, you know, it’s it’s it’s hard to deny those facts that I mean, somebody who makes a new investment, has an empty network, has every economic incentive to price their service competitive in order to get as many customers as possible, paying them something like 20 euros per month, because that’s how you actually recoup your investment right now. So that’s how they could create positive cash flows and so on.

Michael Geist:

So in other words, Canadians can at least take heart in knowing that there is always the possibility that we could go from where we’ve been for many years now. One of the most expensive countries in the world, at least amongst the developed economically developed countries in the world through wireless and can possibly find ourselves in a far more competitive market down the road if we adopt some of the right policies.

Absolutely. Absolutely.

Michael Geist:

Antonios, thanks so much for joining me on the podcast.

Antonios Drossos:

Thanks. Thanks, Michael, for having me. Thanks.

Michael Geist:

That’s the Law Bytes podcast for this week. If you have comments suggestions or other feedback, write to lawbytes.com. That’s lawbytes at pobox.com. Follow the podcast on Twitter at @lawbytespod or Michael Geist at @mgeist. You can download the latest episodes from my Web site at Michaelgeist.ca or subscribe via RSS, at Apple podcast, Google, or Spotify. The LawBytes Podcast is produced by Gerardo LeBron Laboy. Music by the Laboy brothers: Gerardo and Jose LeBron Laboy. Credit information for the clips featured in this podcast can be found in the show notes for this episode at Michaelgeist.ca. I’m Michael Geist. Thanks for listening and see you next time.

Quickly and accurately convert audio to text with Sonix.

Sonix uses cutting-edge artificial intelligence to convert your mp3 files to text.

Thousands of researchers and podcasters use Sonix to automatically transcribe their audio files (*.mp3). Easily convert your mp3 file to text or docx to make your media content more accessible to listeners.

Sonix is the best online audio transcription software in 2019—it’s fast, easy, and affordable.

If you are looking for a great way to convert your mp3 to text, try Sonix today.

Share this:

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on Tumblr (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to share on Pocket (Opens in new window)

- More

Related posts:

No related posts.

I pay about $50 for unlimited Canadian and US roaming and 8GB of data on Freedom .

Was surprised to learn that they still offer the plan for about $60 Cdn when I was in one of their stores recently

Their coverage is ok and with the free roaming, it works out great for me. The data roaming is 1 GB per month

When I asked about similar plans in Ft Lauderdale, the cost was about $120 US