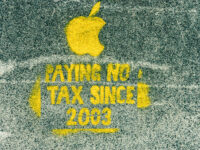

The Canadian government released a detailed document last week outlining the specifics behind its draft Digital Services Tax Act. No actual legislation has yet been passed, but the government is providing guidance on how the potential law would be interpreted assuming it takes effect next year. The document has sparked criticism from business groups and the U.S. government given that it envisions a retroactive three percent tax that will hit a wide range of businesses. Further, the Canadian plan is facing significant opposition from many OECD countries since it may jeopardize a global agreement that is designed to address the digital services tax issue. While the digital services tax (DST) is typically framed as a tax on big tech, the reality is that the Canadian version extends far beyond just companies such as Google and Facebook, potentially including major Canadian retailers such as Canadian Tire, Loblaws, and others.

My view is that unlike Bills C-11 and C-18, which create cross-industry subsidy models funded by tech companies to support government policy, appropriate taxation models is the far better approach to ensure that companies “pay their fair share”. While a DST may be a good approach (particularly if part of a global system), the Canadian plan to implement the tax retroactively next year creates some significant risks. In fact, our current approach raises the prospect of U.S. tariff retaliation, opposition from many allies at the OECD, and expanded news link blocking in response to Bill C-18.