When I first wrote about the arrival of Bill S-210 in the House of Commons back in December, I dubbed it the most dangerous Canadian bill you’ve never heard of and warned that “Senate private members bills rarely become law, but this bill is suddenly on the radar screen in a big way.” Nearly six months later, the bill is closer than ever to becoming law as the Conservatives improbably appear to be doubling down on support and seeking to limit witness testimony through filibuster tactics that could result in a full House vote without any amendments. For those new to the bill, the government has called it “fundamentally flawed” since it contemplates measures that raise privacy concerns through mandated age verification technologies, website blocking, and extends far beyond pornography sites to include search and social media. While the government has opposed it (save for a small number of Liberal MPs), the bill received full backing from Conservative, NDP, and Bloc MPs to send to the Standing Committee on Public Safety for further review. Now that it is there, the Conservative MPs have used filibuster tactics to block all witness testimony on the bill.

Articles by: Michael Geist

Articles by: Michael Geist

A Post I Never Thought I Would Need to Write: Jewish Students Have the Right to Feel Safe on Campus

This is a post I never thought I would need to write in 2024. I have been a law professor at the University of Ottawa for nearly 26 years and the principle that all students, regardless of race, gender, religion, or sexual orientation have the right to be safe and feel safe on campus and in classrooms has been inviolable and accepted as central to our academic mission. Indeed, over the years I have seen and supported colleagues’ efforts to ensure that we practice what we preach on inclusivity and ensuring a community free from harassment and discrimination. I believe the same to be true at academic institutions across the country. Yet since October 7th, something has changed.

The Law Bytes Podcast, Episode 203: Andrew Clement on Calls to Separate Privacy Reform and Artificial Intelligence Regulation in Bill C-27

Bill C-27, Canada’s proposed privacy reform and AI regulation bill, continues to slowly work its way through the committee process at the House of Commons with the clause-by-clause review of the AI portion of the bill still weeks or even months away. Recently a group of nearly 60 leading civil society organizations, corporations, experts and academics released an open letter calling on the government to separate the bill into two.

Andrew Clement has been an important voice in that group as he tracked not only the committee hearings but also dug into the consultation process surrounding the bill. Clement is a Professor Emeritus in the Faculty of Information at the University of Toronto, where he coordinates the Information Policy Research Program and co-founded the Identity Privacy and Security Institute (IPSI). He joins the Law Bytes podcast to talk about AI regulation in Canada, concerns with the bill, and offers insights into the legislative and consultative process.

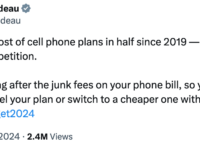

The Law Bytes Podcast, Episode 202: David Soberman on the Reality Behind Claims Canadian Wireless Prices Have Been Cut in Half

Prime Minister Justin Trudeau recently claimed that “we’ve cut the cost of cell phone plans in half since 2019 – in part by increasing competition.” Is that true? What is the real state of Canadian wireless competition and how does pricing compare with other countries? To help answer those questions, this week David Soberman, a Professor of Marketing at the Rotman School of Management at the University of Toronto and the Canadian National Chair of Strategic Marketing joins the Law Bytes podcast. Professor Soberman’s research is focused on understanding how the operation of markets is affected by the exchange of information between organizations and customers, relationships within the distribution channel and the introduction of innovations to markets.