The first two posts of this series on Bill C-11 focused on the risks to user content and Canadian creators. This post picks up on the implications of the bill for consumer costs and choice. In short, at a time when political parties are focused on affordability and inflation, the Bill C-11 effect is likely to increase consumer costs and decrease choice. There is no magic solution that results in hundreds of millions of new money entering the system without someone paying for it. It is fairly clear that that someone will be Canadian consumers as streaming services either hike Canadian fees to account for their new costs or shun the market altogether. It should be noted that it doesn’t need to be that way: a bill that establishes thresholds to exclude smaller services would limit the negative effects on competition and a sufficiently flexible approach to Canadian contributions would recognize that the large streaming services already invest billions in Canada.

While some officials in Canadian Heritage Minister Pablo Rodriguez’s office have said their intent with the bill is to only cover the largest services with hundreds of thousands of subscribers, the bill does not include any such thresholds. In fact, Liberal MPs rejected multiple amendment proposals to add a threshold to the bill. Moreover, Canadian Heritage own internal documentation acknowledges that the legislative plan for the legislation adopts a broad regulatory approach that targets podcast apps such as Stitcher and Pocket Casts, audiobook services such as Audible, home workout apps, pornographic sites, sports streaming services such as MLB.TV and DAZN, niche video services such as Britbox, and even broadcaster websites such as the BBC.

So what is the likely effect of a bill with such broad overreach that the default position is that any audio-visual service anywhere in the world with a Canadian connection (Canadian subscribers or revenues would be enough) is subject to Canadian law?

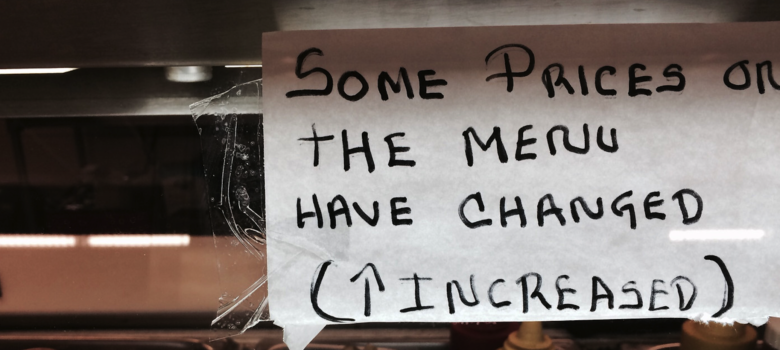

The effect of significant new regulatory costs on these services is likely to spark one of two responses: some services will simply pass along the costs to consumers in the form of new Cancon surcharges, while others will likely block the Canadian market altogether. Regulatory surcharges are not uncommon in Canada. For years, wireless companies included a network system access fee. Today, Rogers maintains a Government Regulatory Recovery Fee, which it attributes to a wide range of regulatory costs. Satellite radio services such as SiriusXM feature a Music Royalty and Administrative Fee. The same is likely to occur under Bill C-11. There are regulatory costs associated with the bill for services of all sizes including filing and data disclosure requirements with the CRTC, potential financial contribution requirements, and compliance costs associated with meeting the new discoverability rules.

The larger streaming services such as Netflix or Disney+ aren’t going anywhere. They are well-established in the Canadian market and will no doubt continue to operate here. Yet at at time when companies such as Netflix are cutting spending, it is unrealistic to think that it will simply absorb hundreds of millions in additional costs to operate in Canada. If those are the costs of Bill C-11, there should be no doubt that it will be Canadian consumers who ultimately bear the costs in the form of higher subscription fees.

The higher costs for streaming services that continue to operate in Canada is only part of the story since a myriad of smaller streaming services may exit the market altogether, leading to less consumer choice, particular for multi-cultural markets. Molotov, Spuul, Kocowa, and Crunchyroll may not be household names, but they are among the hundreds of streaming services that have emerged in recent years to serve a global audience via the Internet. Unless the CRTC provides specific exemptions for these niche services, many are likely to forego the Canadian market entirely, given all the new regulatory costs and the implausibility of meeting Canadian-content requirements.

What do Canadians get for increased costs and less choice?

The truth is the government isn’t sure. While Rodriguez promoted $1 billion in new money when he appeared before the House committee studying the bill, his own department officials backtracked when asked about the issue before the Senate committee in June admitting:

“that figure is intended to be illustrative of the potential impact of the bill on the system…we recognize that even the big streaming services are not the same as your traditional broadcasters that do news, sports, and things like that, so the job of the CRTC will be, in the case of Netflix, say, to figure out what makes sense for Netflix in terms of whether it’s an expenditure requirement or contribution to the system.”

That answers gives away the most likely outcome, which is that Bill C-11 will generate practically no new money from services like Netflix. Netflix told the House committee that it has invested more than $3.5 billion in Canada since 2017. That makes the company one of the biggest investors in film and television production in Canada, yet that spending falls outside of the archaic Cancon rules since Netflix-owned productions cannot by definition be Canadian content even if the film involves Canadian stories, actors, authors, and personnel. While some groups want Netflix to contribute to productions that it can’t own through mandated contributions, the company will either press for changes to the existing rules or shift existing spending into the CRTC-mandated bucket. Either way, the net result of Bill C-11 is little no money for production, less choice for consumers, and higher regulatory costs that are absorbed by consumers in the form of inflationary prices.

Pingback: Liberal censorship bill a “power grab” over free speech: former CRTC commissioner - Globalist News | #Globalist

Do you like challenging multi-player battles? In Stumble Guys, you’ll fight other players while navigating hilarious obstacles. First-place finishers win.