The CRTC has released its much-anticipated Bill C-11 ruling on the initial mandated contributions from Internet streaming services. The headline the Commission and government will promote is that the services will be required to contribute 5% of their Canadian revenues to support various Canadian funding programs that support film and TV production, news, and music. The decision is a perfect illustration of a sector that is too often focused on regulatory payments rather than market-based success with incredible micromanagement of funding in which the CRTC is turned into a policy funding machine of the government (no surprise that government officials spent last week calling stakeholders for advance supportive comments). For the moment, the actual contributions from Internet streaming services are ignored, an updated definition of Canadian content doesn’t exist, commercial success is irrelevant, and subsidies for the news operations of companies such as Bell and Rogers are encouraged. To top it off, the streaming services are required to pay but are unable to access the funds even as they invest in production in Canada. Bill C-11 was about “making web giants pay” and that is what the CRTC was determined to do even if it is consumers that will ultimately get the bill.

The CRTC key objective appears to have been to ensure that the competing groups hoping for some of the streamer pot of gold all get something: 2% for the Canada Media Fund (divided by 0.9% maximum for English and at least 0.6% for French), 1.5% for news, 0.5% for the Indigenous Screen Office, 0.5% for Diversity and Inclusion Funds, and another 0.5% for independent productions. These numbers are significantly above the typical international standard that is closer to the 2% total range, which will make Canada less competitive globally in terms of regulatory costs. The CRTC says that streamers can apportion up to 1.5% of the 2% CMF contribution to their own Cancon (with a maximum of 60% in English), but the problem is that they currently don’t qualify as Cancon creators. There is a similar breakdown on the audio side, with money allocated to everything from new music production to radio station news. Given that audio streaming services already operate on thin margins with the majority of revenues going to licensing, the services may be unsustainable in Canada leading to a market exit (as happened briefly in Uruguay) or significant price increases. At a time when affordability is a major concern, Canadian consumers should prepare for a new Bill C-11 fee on their bill.

Further, the streaming companies themselves will rarely, if ever, be eligible for the money they are required to pay, creating an obvious inequity of mandated payments without benefits. In fact, their existing contributions, which notably include massive film and television production investment in Canada, are entirely ignored. Perhaps to show that it is not entirely beholden to the cultural lobby groups, the Commission upped the minimum Canadian revenue target to $25 million (it was $10 million for registration) and excluded user generated content and podcast revenues from the mix. Yet the bottom line is that companies will likely reduce their existing investments in Canada as the money is reallocated to these regulated payments. In other words, the dreams of massive new film and television production in Canada is an illusion.

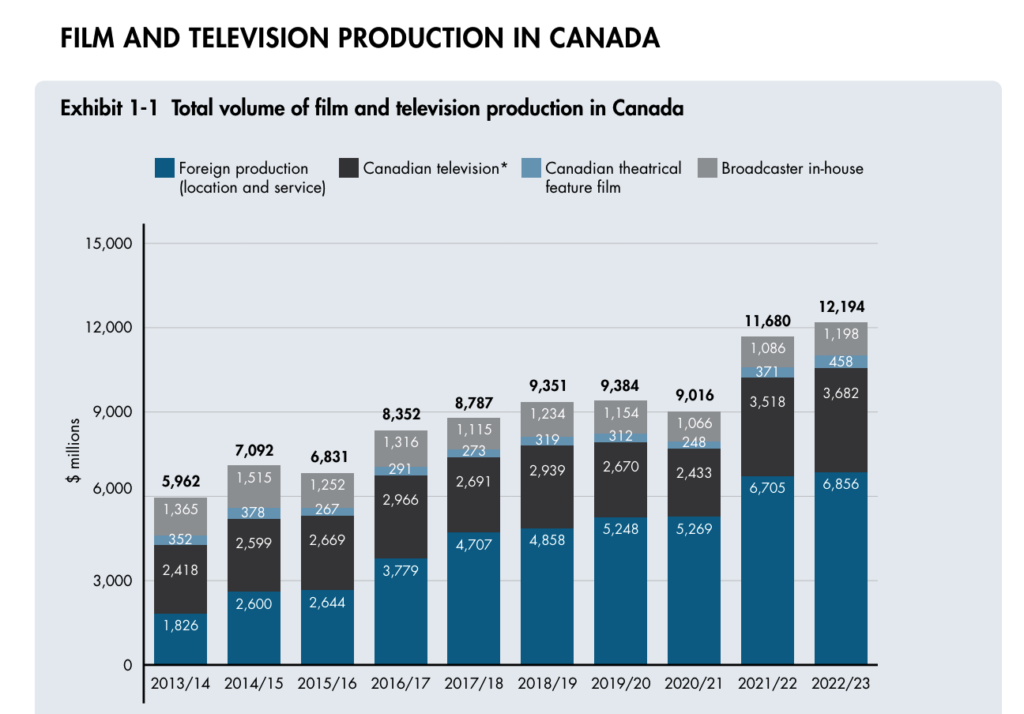

As I argued before the Commission back in December, the reality is that there is no funding emergency in Canada. The latest data shows record amount of spending on film and TV production in Canada with Cancon-based programming growing faster than foreign production.

CMPA, Profile 2023, https://cmpa.ca/wp-content/uploads/2024/05/Profile-2023-English.pdf

The CRTC says it will take years to sort out the various policy issues arising from Bill C-11. Expediting mandated payments under Bill C-11 without addressing the myriad of other issues feels entirely political driven, providing the government with a “win” from its broadcast policy. For example, the bill was supposed to usher in a new definition of Cancon, but this is not done, meaning that the old definition applies to this new money. The bill was also supposed to recognize the existing contributions of streaming services – discoverability, investment, promotion – but none are considered at this stage. Instead, the CRTC says these payments must be made without regard for those contributions.

The creation of even more regulated funding for the news sector raises further concerns. There is no system in place to adequately address how this money will be allocated, so the CRTC has given the Canadian Association of Broadcasters a month to figure out an operational plan for a temporary fund. Unlike the faulty Bill C-18, which was premised on paying for the benefits of linking to news, these payments have no correlation to benefits from news at all. Indeed, requiring Disney or Netflix to pay for news – including to radio stations dominated by companies such as Bell and Rogers – is just a cross-industry subsidy between corporate giants with no veneer of actual linkage between the services and the news sector.

Throughout the Bill C-11 debate, the government insisted that the streaming services needed to pay their fair share. That is an absolutely reasonable position to take, which I argued was best accomplished through taxation. But even if regulated payments were preferred, it is impossible to determine what a fair share is when the Commission hasn’t even calculated what the streamers currently contribute. The CRTC had its marching orders from government and it is clear that it followed them. In doing so, it has turned itself in a government bank for cultural lobby groups in which streaming services and the public provide the funding and the Commission directs the withdrawals.

Agreed that the consumer will be the ones to pay. Expect the prices to go up by 5.26% or more. Some will argue that the payment is only 5% of revenues, but the companies are going to want to maintain at lease the same income after the mandated payment is removed. Lets say that they customer currently pays $100. Since the payment is 5% of revenue, that means that $100 needs to be made from 95% of the amount the customer pays. That brings the cost to the customer as being about $105.26 for the streaming service to receive $100 of it.

As far as your comment about “Further, the streaming companies themselves will rarely, if ever, be eligible for the money they are required to pay, creating an obvious inequity of mandated payments without benefits”, that reminds me of tendency for governments to create government benefits which are income tested; tax monies paid are used to fund the benefit but the more income tax you pay the less likely you are to be able to receive anything under these benefits.

Make $170 per hour. its very hard to find jobs nowadays. In this situation, you have access to a wealth of resources to help you with your working abilities. Be motivated to promote Thousands of works such as copy paste things through job boards and career tr-50 websites on internet

Just Take A Look At This>>>>>>>>>>>>>>> https://madeyourself52.blogspot.com/

JOIN US> Make $170 per hour. its very hard to find jobs nowadays. In this situation, you have access to a wealth of resources to help you with your working abilities. Be motivated to promote Thousands of works such as copy paste things through job boards and career tr-50 websites on internet

Just Take A Look At This>>>>>>>>>>>>>>> https://shorturl.at/gpOfr

Nothing like creating more inflationary pressure so a few can benefit at the expense of the many.

Also, let’s put a middleman in the creative process that will impose application costs on creators, all for 10% or more of the fees paid to the funds

Crave, Sportsnet, Stack TV, and TSN are exempt from this requirement because they are affiliated with Canadian broadcasters. Disney owns 30% of TSN and 20% of FX Canada, so does this mean it is affiliated with Canadian broadcasters and, therefore, exempt from paying the 5% fee?

Pingback: Taxpayers Federation warns new Streaming Tax will make life more expensive - Todayville Edmonton

Pingback: Big news: Foreign streamers music now contribute to Canadian content development | Alan Cross

“Throughout the Bill C-11 debate, the government insisted that the streaming services needed to pay their fair share. That is an absolutely reasonable position to take”

Fair share of what?

Why does a streaming service customer, and that is who will pay, the customer, regardless of what the government or CRTC says, need to pay anything for news, or anything else. When I buy bread in the grocery store should I have to pay to support potato farmers? The stinky system needs to be torn down for good and replaces with NOTHING!

My take on this is that a single mother of three will pay more so that Gerry Dee can have a job.

Pingback: Pay Up and Shut Up: How The CRTC Has Removed Canadians From Broadcast and Internet Policy – getguru.xyz

Please accept my heartfelt gratitude for the author’s tireless efforts in infinite craft conducting thorough research, analyzing various viewpoints, and presenting a well-rounded discussion that encourages critical thinking and meaningful dialogue.