In the months leading up to the release of the Broadcast and Telecommunications Legislative Review Panel report, there was considerable focus on whether it would recommend a “Netflix tax”, a catch-all term that has come to mean digital sales taxes, corporate taxes, and mandated contributions to support the production of Canadian content. The report contains a curious paragraph in its overview in which it claims that the panel is not recommending a Netflix tax. It states:

We want to be clear that we are not recommending that Canadian content be supported by the so-called ‘Netflix Tax’ – charging consumers an extra levy on subscriptions to such services as Netflix. It is more appropriate to establish a regime that requires such online streaming services that benefit from operating in Canada to invest in Canadian programming that they believe will attract and appeal to Canadians. This approach would ensure a meaningful contribution to Canadian cultural policy objectives and the production sector. It need not result in higher prices for consumers.

The reference to a Netflix tax in the overview is the only such reference in the 235 page report. It was likely included in the overview in the hope that media coverage would jump on the claim and seek to re-assure Canadians that there was no Netflix tax or higher prices likely for consumers as a result of the report’s recommendations.

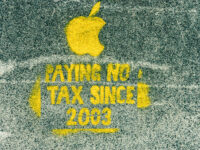

Yet the reality for anyone that reads beyond the overview is that the panel’s report not only recommends what would widely be considered a Netflix tax but proposes perhaps the biggest Internet cash grab in the OECD with mandated payments and levies on thousands of Internet services with Canadian users.

Read more ›