The ongoing furor over Netflix taxes remains one of oddest and most poorly understood public policy debates in recent memory. Part of the problem is that a “Netflix tax” has long been used to mean different things to different people. When first raised by the Conservative government, the issue had nothing to do with sales tax. Rather, a “Netflix tax” was a reference to a mandated contribution to help fund Canadian content, a position supported by various cultural groups and some provincial governments. The no-Netflix tax position took hold, however, and all three major parties adopted the position that they would not mandate contributions from online service providers such as Netflix.

More recently, the debate has shifted to Netflix tax as a sales tax with the goal of creating a “level playing field.” I tried to debunk the level playing field claims in this post and on Canadaland, but the claims of the need for a level playing field and sales tax continues. Yesterday, the NDP stated:

All companies, whether they are Canadian or foreign, should be paying their fair share. It is the federal government’s responsibility to level the playing field, and this means making sure that all companies that do business in Canada pay their taxes.

This was reported as a shift in position, but the prospect of sales taxes on Netflix and similar services has been under consideration by successive governments for several years. In fact, it was the Conservatives who first launched consideration of the application of sales taxes to foreign online providers in 2014. Department of Finance officials appeared before Standing Committee on Canadian Heritage last year to discuss the issue:

E-commerce sales by foreign-based companies can present a challenge for proper sales tax collection. Foreign-based Internet vendors’ businesses with no physical presence in Canada are generally not required to collect GST/HST on their sales. Instead, in the case of physical goods that are purchased online and shipped to Canada by post or courier, the applicable customs duties and GST/HST would generally be collected by the Canada Border Services Agency at the time the goods are imported.

In cases other than the importation of physical goods, the GST/HST legislation imposes a general requirement to self-assess the tax. For businesses that would be entitled to recover any tax payable by claiming input tax credits, there is generally no requirement to self-assess tax on such imports.

The challenges related to the proper collection of sales tax on digital supplies by foreign-based vendors are not unique to Canada. It’s a difficult issue for all jurisdictions with a sales tax. In this regard, the issue was examined as part of the recent initiative of the G20 and the Organisation for Economic Co-operation and Development to address what is known as “base erosion and profit shifting”, or BEPS.

Interest in the issue was so intense that Members of Parliament immediately proceeded to grill officials about how to ensure that sales taxes on Netflix would be paid. Just kidding. After the opening remarks, Liberal MP Julie Dabrusin quickly shifted the focus to charitable status for non-profit media organizations, MP Dan Vandal asked about tax credits for film and video production, and MP Kevin Waugh asked about tax credits (MP Pierre Nantel got things back on track by asking GST experts about GST).

While there is some inevitability to sales taxes on services like Netflix, the outrage is hard to understand since sales taxes are paid by consumers, not service providers. Providers collect the tax from consumers on behalf of the government and then remit what they have collected. There is presumably an administrative cost to collecting and remitting the tax, but sales tax collection is not about “paying their taxes” and companies like Netflix have indicated that they will collect and remit if required to do so.

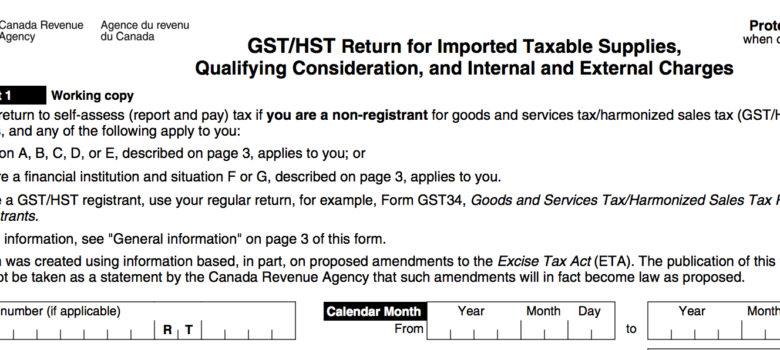

But for those who believe sales taxes should be paid now, there is no reason to wait. At the Heritage hearing, the finance officials noted that the law technically requires consumers to self-report the applicable tax and remit it directly. The department doesn’t actively enforce this rule, but there is nothing to stop those who think that their Netflix subscriptions should be subject to sales tax from paying it since they can always self-report what they owe by completing this form to help create the “level playing field” they insist is missing.

Next time I resd a blog, I hope that it won’t fail me as much

as this one. After all, I know it waas my choice to

read, but I really believed youu would probably have something helpful to say.

All I hear is a bunch of complaining about something you can fix iff you weren’t too busy seeking attention. https://plus.google.com/+ClintButler/posts/V21ibWyFP8P

9 2 9 Jake Paul http://pixelsucht.net/actionbrowser-cc-photoshop-panel/forums/topic/steroide-kaufen-munchen-9864565/

Hello You fuck me in the ass rather my nickname (Anfiska09)

Copy the link and go to me… bit.ly/2gcyrSL

8659242232310