The cost of wireless services emerged as a political issue during the recent national election, with most parties taking turns promising measures to increase competitiveness and lower consumer costs. The Liberals based their platform on a commitment to reduce costs by 25 per cent over the next two years, a measure that some analysts suggested had already been met. I argued that the 25 per cent reduction target was measuring the wrong thing, noting that “the 25 per cent price decline may sound attractive, but if other countries experience declines of 30 per cent or 40 per cent, it means that Canadians would actually be paying even more relative to consumers elsewhere.”

A new report out today from Rewheel Research, a Finnish consultancy, confirms these concerns as it shows that Canadian pricing may be declining, but the market has actually become less competitive when compared to other developed economies. Rewheel has called attention to Canadian pricing issues in the past and Antonios Drossos, managing partner of the firm, joined me on my Lawbytes podcast to discuss the issues over the summer. The latest report, based on pricing in markets worldwide available this month, notes:

While the Canadian median gigabyte price in smartphone plans fell during the second half of 2019, Canada’s competitiveness among the EU28 & OECD countries further worsened. Canada was ranked as the country with the fourth highest median gigabyte price in April 2019. In October 2019 Canada became the second most expensive country.

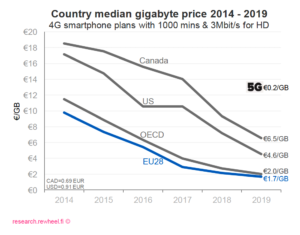

This chart demonstrates how Canadian price declines are not keeping pace with other countries:

Rewheel Research, The state of 4G & 5G pricing, 2H2019: more-for-less, http://research.rewheel.fi/insights/2019_oct_pro_2h2019_release/

In fact, notwithstanding the much-touted price declines, the reality is that “the median smartphone plan gigabyte price in Canada was 18 times higher…than the median prices in 4-MNO competitive large European markets.”

Rewheel Research, The state of 4G & 5G pricing, 2H2019: more-for-less, http://research.rewheel.fi/insights/2019_oct_pro_2h2019_release/

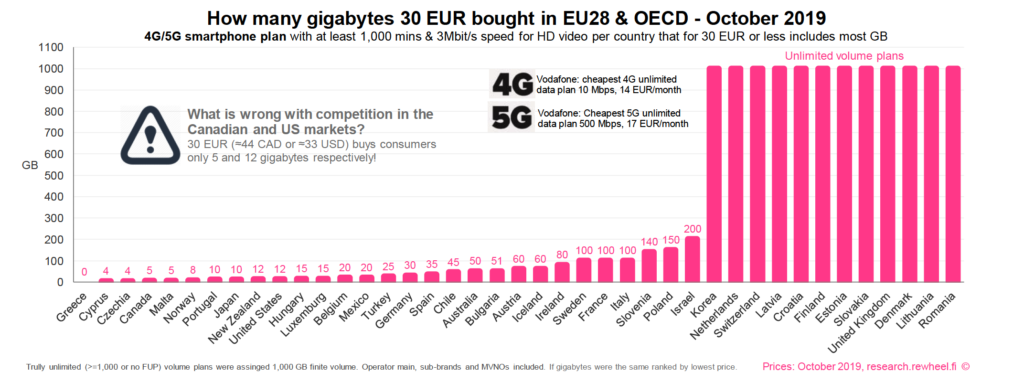

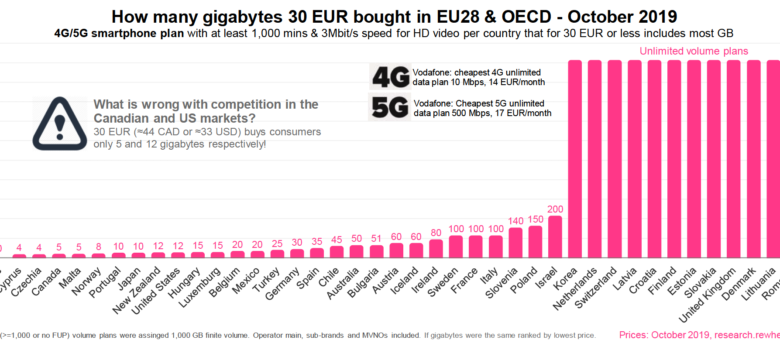

It is also worth noting the Rewheel has also begun discounting the “unlimited” plans that recently entered the Canadian market, treating it as a finite plan based on the amount of data available before the provider slows or degrades the accessible speed. Based on global market standards, unlimited requires at least one terabyte (1,000 GB) of data and no throttling of speed below 3 Mbps. By comparison, the Rogers “unlimited” plans go to a maximum of 50 GB and throttle to 512 Kbps. In other words, not only are Canadian wireless plans uncompetitive, but even the new unlimited plans do not measure up to many other countries.

The price issue on telecommunication only show how submitted to the industry the Canadian government is… In that field!

Unfortunately, it is the same across the board!

Pingback: News of the Week; October 30, 2019 – Communications Law at Allard Hall